While the global beauty industry shifts towards digital and independent brands, China’s market remains dominated by legacy brands like La Mer and Dior, with consumers favoring established names for their heritage and tech innovations. To compete, Chinese beauty brands must enhance their online presence and influencer marketing.

Published On: February 12, 2019

The global cosmetics market is expected to grow by 7% between 2018 and 2023 and this growth has become a hotbed for digital disruption. ‘Born-digital’ and independent beauty brands have been growing four times as fast as the larger legacy brands, revealing a clear preference for novelty among global beauty consumers. Our own analysis further supports this shift as born-digital brands were the most talked about type of beauty brand among influencers in France, UK and USA for Q4, 2018 as shown in our new White Paper with CEW France; “The State of French Beauty Influence” which is coming soon.

Moving further east and China’s cosmetics market mirrors the global market in that it is also expected to experience growth (4.5%). However, this is where the comparisons end.

By taking a deep dive into the online conversations happening in China, we have found that legacy brands continue to maintain their influence in the region.

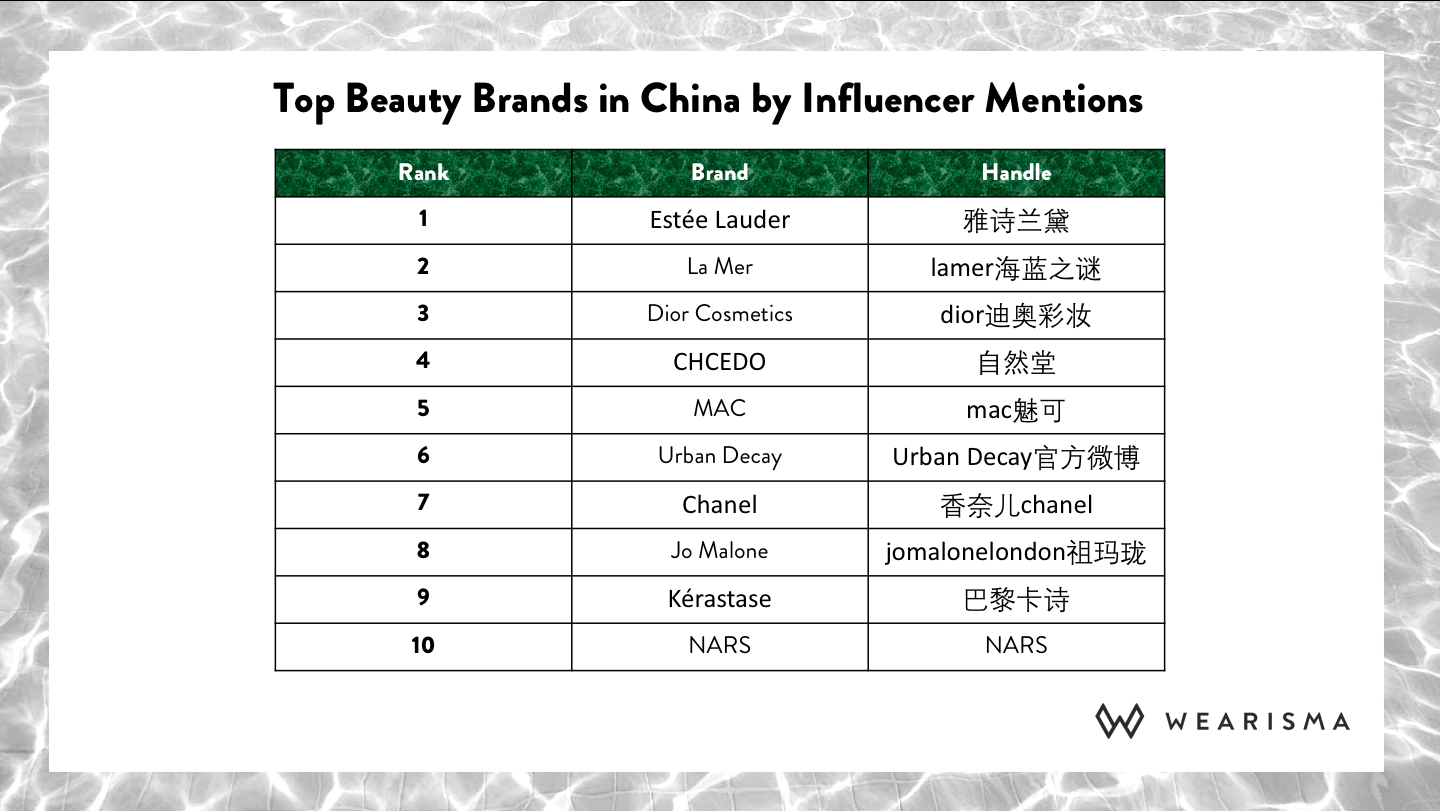

When analysing the most mentioned beauty accounts among Chinese Influencers on Weibo in Q4 2018, our analysis revealed a total absence of new, independent beauty brands and a distinct lack of born-digital brands. Rather, the results revealed that China is steadfast in its love affair for the legacy beauty brands.

8 out of the top 10 beauty brands in China are 25 years old or more

Due to their history, legacy brands like La Mer (the second most mentioned beauty brand on Weibo) typically maintain a higher price point than newer, digital and independent beauty brands. With more than half of Chinese consumers professing a desire for more expensive products coupled with a country-wide increase in household incomes, it is understandable why legacy brands are popular among Chinese Influencers.

The type of products promoted by La Mer may also be an attributing factor to the brand’s success in the region. For example, “The La Mer Dare” series featured heavily on Weibo and featured actress sisters Sara and Erin Foster engaging in comedic challenges involving the brand’s Treatment Lotion Hydrating Mask. Skincare products have been revealed to be the fastest-growing product type in China’s cosmetics market. Chinese consumers have also been shown to take a specific interested in the cosmeceuticals; products that combine cosmetic and pharmaceutical features such as those promoted by La Mer.

French and American Multinational Players Dominate the Cosmetics Market in China.

The majority of the most mentioned beauty brands are owned by US based Estee Lauder Company and France’s L’Oréal Group. While CHCEDO (CHANDO), owned by The Jala group is the fourth most mentioned beauty brand, it is the only Chinese brand in the top ten. These results support reports of Chinese perceptions of western beauty brands as being more high-end and therefore more attractive.

The ‘Made in France’ label in particular is said to hold a particular affinity among Chinese consumers who associate the label with an increased level of brand trust. Dior cosmetics is the third most mentioned beauty brand among Chinese Influencers and the brand’s French heritage is only one contributing factor to its success, their integration of new technologies also plays a pivotal role.

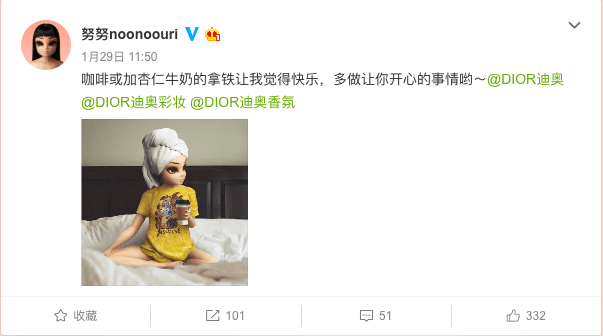

Euromonitor reported that the adoption of new technology, such as augmented reality (AR), helped to promote sales of beauty. Last summer, Dior became one of the first beauty brands to utilise a virtual influencer Noonouri within their social media strategy. Similarly, in 2017, Dior further ignited China’s love affair with technological advancements by becoming the first luxury brand in the country to use the new Weibo Story feature to release social media content – a move which clearly delighted Chinese Influencers.

Estée Lauder and Mega-Influencers – A Winning Formula

An investigation by Kantar Worldpanel highlighted the significant role that young women in their 20s play in China’s cosmetics market and reports have suggested that this demographic are highly swayed by celebrity influencers. Besides the company’s primary brand ambassador Actress and Singer Mi Yang, Estée Lauder has worked with celebrities from various fields, such as Olympic diving gold medallist Guo Jingjing. The brand’s method of working with Chinese celebrities and Mega-Influencers provides additional context to its winning position.

Conclusion

Chinese consumers continue to be brand conscious, equating well-known, western legacy labels with a higher caliber of products. While Chinese beauty brands like Pehchaolin, Marie Dalgar and Chioture, who all made the top 20 (taking the 14th, 18th and 20th spot, respectively), are slowly beginning to resonate with Chinese beauty consumers online, they still have a way to go.

Increasing their online presence via enhanced Influencer Marketing practices would be a viable option for Chinese beauty brands looking to compete with western legacy brands. Bolstering their online presence via engaging and innovative content could allow them to challenge the traditional beauty ideals held by many consumers in the region.

Keep informed with the latest trends, reports, and case studies from the world of influencer marketing.

WeArisma’s 2025 State of Luxury Report has been featured WWD! Amongst the numerous metrics for luxury brands to benchmark against competitors, we highlight Resonance and Virality as crucial, underlooked criteria.

WeArisma’s Beauty 2025 State of Influence Interactive Report – Your Essential Guide to Beauty Brand Success in the Digital Age.

The beauty landscape is evolving. Traditional strategies no longer guarantee success – Resonance, Virality, and Authentic Engagement are beginning to define market leaders.

Our latest Beauty 2025 State of Influence Report uncovers the key shifts shaping Skincare, Makeup, and Fragrance, and the strategies fueling sustained impact.

Influential voices have delivered outstanding Ripple Impact for the world’s top-performing beauty brands, collectively reaching and engaging far more consumers than brand owned social media channel. They:

Reached up to 26X more consumers, generated up to 19X higher EMV, produced up to 73X more content, and drove up to 83X greater Engagement

This interactive report lets you explore key performance metrics, compare data across countries, and discover which luxury brands lead the rankings.

Stay up to date with the latest industry trends and topics

Discover how WeArisma can help you harness the power in influence, grow your brand’s presence, and achieve measurable success.

WeArisma combines the power of AI, influencer marketing and social listening to deliver smarter, scalable strategies with real impact.