In August, Weibo reported a 70 million user increase in Q2, reaching 431 million monthly active users, alongside a 68% rise in net revenues to $426.6 million, fueled by a 69% increase in advertising and marketing revenues, while Gartner’s L2 Digital IQ Index on Beauty prompted an analysis of beauty brand performance on Weibo for the month.

Published On: September 13, 2018

In August, the Chinese microblogging platform, Weibo announced that it saw an increase of growth in Q2 (via younger users joining the platform) of 70 million additional users amounting to a total of 431 million monthly active users.

Weibo is on the rise again as this is coupled with net revenues of $426.6m in Q2 – a 68% increase year-on-year. The rise driven by robust advertising and marketing revenues, grew 69% year-on-year to reach $369.9m.

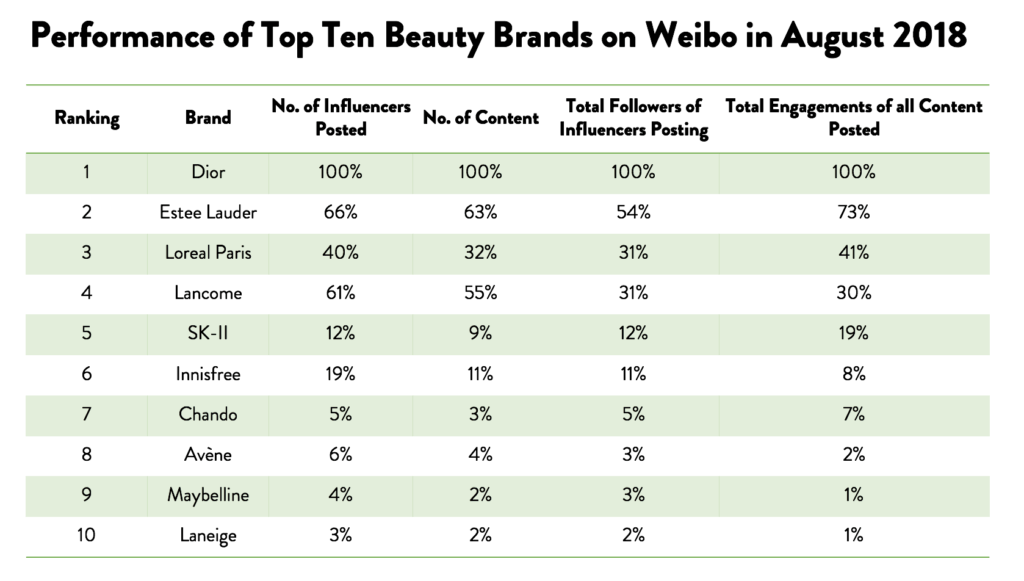

Earlier this year, Gartner’s L2 published their annual Digital IQ Index on Beauty in China for 2018. Using this, we decided to take a look at how well these beauty brands did in terms of coverage on Weibo during the month of August.

“Lorem ipsum dolor sit amet consectetur. Diam platea at tempor ut ut egestas venenatis. Placerat eros eget commodo ut cursus. Enim libero nibh facilisis est. At phasellus mauris ornare posuere consequat. Quam lacus curabitur consectetur amet libero tortor eu volutpat sit. Venenatis eget aenean in enim.”

International luxury fashion brands are quickly dominating the makeup space in China, therefore it is no surprise that the brand that dominated beauty on Weibo is Dior Makeup. Dior has seen huge success via digital in China and has notably been the first to sell on WeChat and adopt Weibo Stories in order to stay ahead of the curve. The success of Dior Makeup in China can be traced back to the fact that the Dior Make Up range acts as a gateway product which is accessible and can be bought online as quality from the brand is assured. Being an early entrant has lead Dior becoming the most engaged brand on Weibo in August.

That said, Estee Lauder is not that far behind Dior. Despite them having only half the total follower reach of Dior, the number of engagements they receive are only 30% behind meaning that despite having a tinier audience, that audience is still incredibly engaged. This could be down to Estee Lauder’s recent efforts to rejuvenate the brand and cater towards a younger demographic, which in 2017 led to a huge 40% increase in sales.

Another interesting case study for the month of August is L’Oréal Paris. Their strategy on Weibo is communicating on both a micro and macro level. All ten of their most followed influencers have over 5 million followers. They complement this with targeting micro influencers who deliver vast pieces of content. For instance, on average, every micro influencer that posted about L’Oréal Paris on Weibo has at least 3 pieces of content each. Doing this micro and macro approach helps L’Oréal Paris to generate a vast quantity of engagement on their content but also leads to higher brand awareness.

Keep informed with the latest trends, reports, and case studies from the world of influencer marketing.

WeArisma’s 2025 State of Luxury Report has been featured WWD! Amongst the numerous metrics for luxury brands to benchmark against competitors, we highlight Resonance and Virality as crucial, underlooked criteria.

WeArisma’s Beauty 2025 State of Influence Interactive Report – Your Essential Guide to Beauty Brand Success in the Digital Age.

The beauty landscape is evolving. Traditional strategies no longer guarantee success – Resonance, Virality, and Authentic Engagement are beginning to define market leaders.

Our latest Beauty 2025 State of Influence Report uncovers the key shifts shaping Skincare, Makeup, and Fragrance, and the strategies fueling sustained impact.

Influential voices have delivered outstanding Ripple Impact for the world’s top-performing beauty brands, collectively reaching and engaging far more consumers than brand owned social media channel. They:

Reached up to 26X more consumers, generated up to 19X higher EMV, produced up to 73X more content, and drove up to 83X greater Engagement

This interactive report lets you explore key performance metrics, compare data across countries, and discover which luxury brands lead the rankings.

Stay up to date with the latest industry trends and topics

Discover how WeArisma can help you harness the power in influence, grow your brand’s presence, and achieve measurable success.

WeArisma combines the power of AI, influencer marketing and social listening to deliver smarter, scalable strategies with real impact.